Editor’s note: Originally published at tsi-blog.com on Nov. 30, 2020.

A lot of widely-held beliefs associated with the financial markets and the economy are in conflict with the historical record and/or logic. One that I have addressed many times in the past is the belief that gold tends to be relatively strong when inflation expectations are rising.

Rising inflation expectations eventually could transform into a collapse in monetary/economic confidence, at which point gold would exhibit extreme relative strength. However, the run-of-the-mill increases in inflation expectations that occurred over the past few decades generally led to weakness in gold relative to the basket of commodities represented by the S&P Spot Commodity Index (GNX).

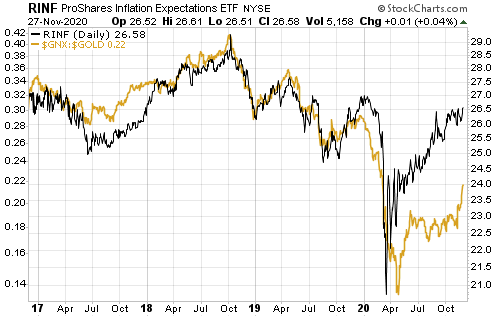

Here’s an update of the chart I have presented in previous blog posts that illustrates the relationship mentioned above. The chart shows a strong positive correlation over the past four years between the GNX/gold ratio and RINF, an ETF designed to move in the same direction as the expected CPI. That is, the chart shows that a broad basket of commodities tended to outperform gold during periods when inflation expectations were rising and underperform gold during periods when inflation expectations were falling.

As an aside, related to the above chart is the following chart comparing the commodity/gold (GNX/gold) ratio with the yield on the 10-year Treasury Note (TNX). Given the positive correlation between the commodity/gold ratio and inflation expectations, it isn’t surprising that there is a positive correlation between the commodity/gold ratio and the 10-year interest rate.

This year, inflation expectations bottomed in March and then trended higher. That’s the main reason why, in TSI commentaries over the past seven months and especially over the past two months, I have written that it was appropriate to favour industrial commodities over gold.

I currently expect the rising inflation expectations trend to continue for another 2-3 quarters. This means that I expect continued outperformance by industrial commodities for another 2-3 quarters, of course with corrections along the way. A correction (a period of relative strength in the gold price) actually could begin soon, partly because the gold price is now stretched to the downside while the prices of commodities such as copper, zinc, oil and iron-ore are stretched to the upside.